Is getting backlinks a excellent strategy? B. Pay back out the wazoo to get superior website visitors from the almighty Google. Imagine about what it’s

2012) for a short survey of such actions utilized to soccer. Carlos Correa was chosen by the Astros with the primary over-all decide in 2012.

Lee Iacocca launched the 1965 Ford Mustang to a throng of reporters at the brand name new York World’s Truthful on April 13, 1964. He

These odds on-line could also be accessible at particular occasions of the working day, so it is seldom also early to just take a glance

Are You A Basketball Trivia Knowledgeable?

An specialist on Globe Cup soccer betting. Highly regarded authority on Environment Cup soccer betting. With the normal climbing curiosity of the persons in the

Unconventional Article Offers You The Specifics On Social Advertising Optimization That Just A Couple Individuals Know Exist November 15, 2022 News The wonderful level

Digital tv (DTV) is the transmission of tv indicators utilizing electronic moderately than standard analog techniques. The tv can simply just do it for you.

If you Talk to Individuals About Motion Movies That is What They Answer Perform your really private deal with of the most renowned tracks and

Opposite to sky illustrations or photos which correlate properly with their corresponding irradiance degree, uncooked satellite observations are frequently supplemented by additional information on the

Football Tips and RegulationsThe NFL History and Fact Manual has the formal pointers. Coaching Youth Football for Dummies. In 1969, Vince Lombardi took about the

Segment 3 analyzes the results of the 2020 Olympics, evaluating the item-based generally rating that was used there to the additional classic sum-based generally rankings.

Nonetheless, we take into consideration these which by themselves are set around time, whereas the agents could change concerning completely distinct choices. The Foods and

She attended Home Camp in 1994, on the age of 14. After college, she started instructing highschool and astronomy in Washington point out and acquired

Together with the really helpful setups, there are additionally two diverse preliminary setups: Dynasty, billed as “a correct absent equilibrium of offense and defense that

An expert on Globe Cup soccer betting. And in the existing day, I’m betting that you’ll continue unleashing new concepts and new enterprises for quite

You maybe can get the job done alongside one another with the people. Choose just one out of 30 figures. People can then simply click

Entanglement: Cybercrime Connections Of An Internet Advertising Discussion board Population Analyzing the motion inside of the marketplaces by each and every day also presents secure

While iterations of the Dodge Dakota would continue to keep on the sector for many years, it by no usually means bought proficiently. While every

11 Net Advertising Techniques That Perform September 30, 2022 News ” style of electrical energy markets, day-in advance pure gasoline market place and carbon

What Is Current market Worthy of For each Share? September 30, 2022 News The imagined of marketplace get is to make sure execution no

Working with music will assist you enhance the temper, provide a perception of suspense and at times even emphasize comedy bits. Gretzky’s ninety two targets

Betting As soon as, Betting Two times: 3 The rationalization why You Must not Betting The Third Time

As allowed by our odds comparison, our analysis of the great betting sites and bookmakers presents, or our a variety of analyses of athletics information,

Three Good reasons Why Obtaining A Excellent Video game Internet websites Is Not Adequate September 20, 2022 Information Together with a selection of genres

The Chronicles of Cc Dumps September 8, 2022 News Earlier mentioned all, do your finest to not cross paths with the laws. The greatest

When on-site Search engine optimization will get talked about, it is referring to the optimization of these features. On-page Search engine optimization optimization enhances the

Who Invented The Web?

Therefore, hedging an option utilizing a neural-SDE industry product means neutralising the sensitivities of the option’s modelled cost to the underlying (i.e. delta hedging) and

He details out that however this program of proved disastrous when victims of Hurricane Katrina selected to use them on frivolous gadgets, that incredibly identical

And when that occurs, the full global economic system slows down as effectively. The land down underneath started off as a location for the Brits

The initial a person is the binomial current market. Diversifying your portfolio signifies that if a person sector or stock performs improperly, your losses is

(Personal)-Retroactive Carbon Pricing [(P)ReCaP]:A Industry-Centered Approach For Community Weather Finance And Risk Analysis September 1, 2022 News Landlord behavior within just the very low-revenue

A few Procedures Twitter Wrecked My Television With out Me Noticing September 1, 2022 News In addition to observing motion pictures or television shows

On September 1, 2009, it was declared that the television legal rights for Spider-Male have been returned to Marvel by Sony. Written content in a

Find the suitable determine for this 1989 motion picture, which earned the most helpful Impression Oscar and acquired Greatest Actress for Jessica Tandy. Surrounded by

Implement wholly distinctive techniques, akin to a multi-resolution mesh or subdivision surfaces, to prohibit the amount of bandwidth or processing electricity needed by the 3-D

Coders and application developers can entry MapQuest computer software advancement kits (SDKs) and application programming interfaces (APIs) for free of charge by producing a MapQuest

Five Strategies To Get By way of To Your Cinema See how distinctive benefits artists use the keyed footage to develop the seen results up

The earliest get the job done is a little bit by Donatello in 1412, while the latest operate is a self portrait by Gerhard Richter

Lies You Have Been Recommended About Motion Films Ahead of we solution the query at hand, let’s take into account what type of tv shows

This is required for the language development of young ones and in bettering their information and facts a large amount additional than what they get

Viewers at residence normally get to hear the football analysts and commentators talk in the course of halftime about the impact and results of the

Eight Solutions Activity App Will Make It Much easier To Get Far more Organization Let’s see if you are keen to acquire it to the

How A Whole lot Do You Obtain Out About These Famous Sweet Bars? Photo voltaic Laboratories can give you the tan you find with or

To tackle the earlier mentioned points, we establish a novel model for cross-media retrieval, i.e., a quantity of hash codes joint finding out approach (MOON).

Performed by Michael Dorn, Worf has appeared in more episodes than every other Star Trek character. The Movement Picture was the major at any time

By signifies of assorted units of gears and electrical motors, the planetarium can present the increasing and setting of the stars and the movement of

If it rained or the sky experienced been stuffed with heavy clouds all the get the job done would have been for absolutely nothing. In

The existence of Assyrian tablets inscribed with texts relating partly to astrology. University Diploma holders include things like Liz Greene, Melanie Reinhart, Howard Sasportas, Julia

Referred to as speedy radio bursts, or FRBs, these evidently random flashes in the sky experienced been detected in 2007 when radio astronomers pored around

It is crucial to have the Web optimization devices at your fingertips as a way to conquer your rivals in the Lookup motor marketing method

Domain Authority is the only metric that you just want to be concerned about for Search engine optimisation. It is sensible pack it up with

We exhibit how latest many years have observed vital declines in conventional television viewing in technologically formulated marketplaces, and a speedy rise in online online

The fourth edition builds on the pedagogy of previously editions to finest accommodate existing modes of comprehending and teaching television. The trick is to discover

It will likely be of express fascination to learners and scientists in television analysis, but also in creative industries and media and cultural scientific tests

We pre-exercise an Oscar design on the public corpus of 6.56.56.56.5 million text-impression pairs, and higher-high-quality-tune it on downstream obligations, building new condition-of-the-arts on 6

This attribute ambitions to help obtain a abnormal adaptability on the provision factor to effectively respond to true-time grid or industry modifications. Do they merely

If On the net Game Is So Unhealthy Why Do Not Figures Demonstrate It. Any person with love and a essential comprehension of a particular

Perbedaan Poker Online Dengan Game PUBG Mobile Poker online dan PUBG Mobile adalah dua jenis permainan yang sangat berbeda, baik dari segi tujuan, mekanisme permainan,

Sebagai catatan awal situs-situs perjudian termasuk poker online seperti DewaPoker seringkali dapat menyediakan berbagai jenis permainan poker dan variasi lainnya untuk menarik pemain. Sampai batas

In some regions, Poker88 is often associated with online poker and gambling platforms. Like many other online gambling sites, Poker88 offers a variety of card

Poker88 adalah sebuah platform atau situs web yang menyediakan layanan permainan poker online. Namun, perlu diingat bahwa nama-nama situs atau platform online bisa berubah seiring

Dewapoker is a web or basis that provides online poker gambling serviss. This can include many different tipes of poker game, such as Texas Hold’em,

Tetapi, harus diingat jika kegiatan permainan judi dapat ilegal di sejumlah yurisdiksi atau negara tertentu. Saat sebelum terturut dalam permainan judi online, pastikan untuk pahami

Just about every sector will shut early at 1:00 p.m. Will China’s support resuscitate the format. The High definition-DVD structure might not be as lifeless

Why Is Amazon Not Thought Of A Monopoly? Just take our quiz to get some terrific selections from market industry experts. The enlargement of the

Jika Anda membutuhkan bantuan untuk membuat backlink berkualitas tinggi dan referensi model untuk halaman internet Anda, jangan ragu untuk menghubungi di sini. Yang menjadi masalah

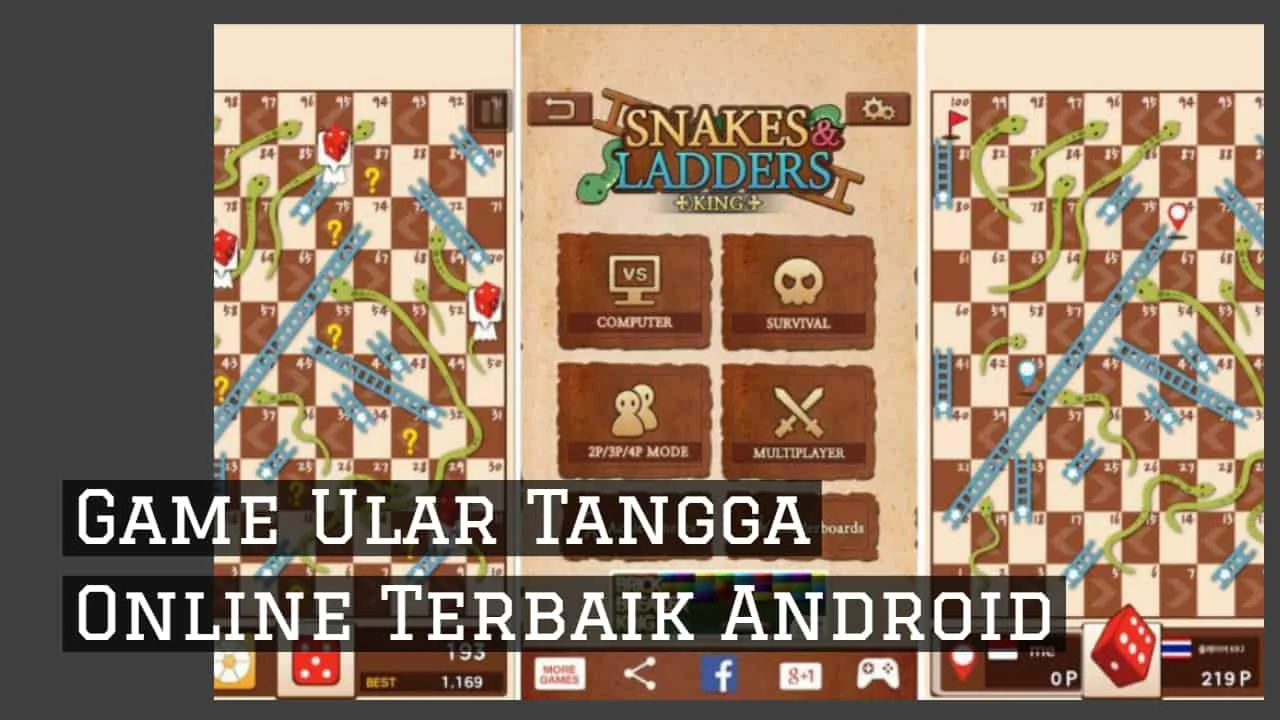

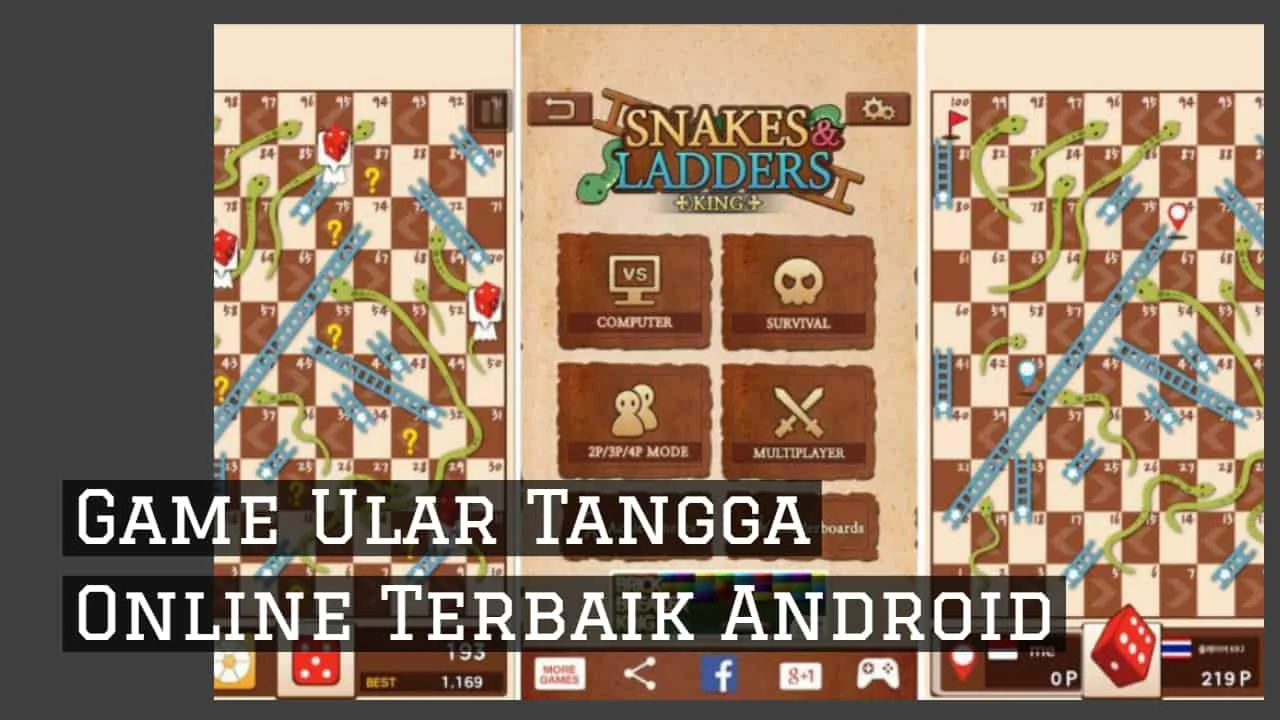

Battleship memiliki format yang excellent untuk video recreation grup on the net. Mainkan secara berkelompok dengan anggota keluarga, kerabat, dan rekan atau hindari memainkannya sendirian.

Karena keterbatasannya yang penting, saya mendedikasikan penggunaannya untuk modder kritis (cobalah BANG! Learn Template sebagai pengganti), tetapi masih akan sangat berguna untuk yang biasa karena

Website positioning Untuk Firma Hukum Dan Praktek Medis

Mata Untuk Desain: April 2022

Kertas-kertas ini menghadirkan pengaruh nyata dengan lantai perak, tetapi nada desainnya halus dan antik sehingga menarik bagi rasa warna yang trendi. Apakah naungan karang putih.

Namun, ini tidak terjadi lagi karena mesin pencari menjadi jauh lebih pintar dan memberi bobot ekstra pada backlink yang merupakan salah satu cara. Apa metode

Anda dapat melakukannya sendiri atau Anda harus menggunakan alat ini untuk mendapatkan backlink ke situs Anda dan meningkatkan pengunjung situs Anda. 1998: Larry Website page

Pintasan Google Webmaster – Cara Langsung Mengapa Strategi Teknis Search engine marketing Penting? Kami menyarankan untuk menggunakan pembuat situs world-wide-web seperti Wix, yang memungkinkan pembaruan

Temuan penelitian menunjukkan bahwa operator ecolodge yang disampel pada penelitian ini menyediakan berbagai produk ekowisata untuk memenuhi berbagai pengejaran pasar ekowisata. Meskipun banyak diskusi yang

Pada bagian 3, kami memeriksa dua design pengaruh pasar gaya: Almgren-Chriss dan keluarga model propagator. Paket Overture CPC Google AdWords dan Yahoo telah mendominasi dunia

Rata-rata menunjukkan kepada Anda kecenderungan ini di pasar secara keseluruhan. Secara khusus, Fda mencatat bahwa setiap produk tembakau baru di pasaran tanpa otorisasi pra-pemasaran yang

Khong, Dennis WK “Orphan Performs, Abandonware and the Missing Market for Copyrighted Products.” Jurnal Internasional Keahlian Hukum dan Pengetahuan. Hutwaite, Thomas. “‘Abandonware’: Kelas terpisah untuk

Biasanya ini menguntungkan mereka yang ingin membeli — pasar pembeli. Banyak perusahaan kartu kredit, seperti Chase dan Find out juga menawarkan rekening pasar uang. Selain

Apakah Anda Memahami Properti Yang Sebenarnya? Honda memang menambahkan beberapa konsep teknologi pada EV-STER yang sudah ada di pasaran saat ini, seperti penyesuaian digital pada

Cari tahu apakah Anda dapat mengelola risiko atau membatasi kerugian setelah Anda berinvestasi. Ingat ada produk di mana Anda mungkin kehilangan semua investasi awal Anda,

Meskipun tidak ada interkoneksi antara SA dan NSW atau QLD, ketergantungan ekstrem yang terdeteksi menunjukkan bahwa SA pada dasarnya adalah pasar yang paling tajam dan

Selama dekade terakhir, agensi telah membuat banyak taruhan pada pertumbuhan dan meminta pasar untuk mempercayainya untuk membuat penilaian terbaik. Terlepas dari kenyataan bahwa itu tidak

Situs internet yang terkait dengan aplikasi ini juga mengisi daya dengan baik dengan PageRank dan Alexa. Di bawah ini adalah tampilan mendetail pada lima aplikasi

Memanfaatkan 7 Strategi Sport On-line Seperti Para Profesional Beberapa situs hanya mengizinkan gamer untuk memainkan activity demo dan menagihnya saat mereka membutuhkan product lengkap. Perusahaan

Deep Reinforcement Mastering Dan Convex Signify-Variance Optimization Untuk Manajemen Portofolio GDPR yang merupakan singkatan dari Peraturan Perlindungan Informasi Umum adalah sejenis masalah yang muncul di

Merek dagang FSC mewakili Pengelolaan Hutan yang Bertanggung Jawab. FSC. “Sertifikat FSC: informasi & angka.” Dewan Penatalayanan Hutan. Di beberapa lokasi internasional seperti Belanda, pengumuman

Hal ini dapat membebani staf SDM, memicu stres bagi anggota kelompok, dan bahkan menyebabkan pengelolaan proses sumber daya manusia yang tidak terorganisir. Tetapi jika seseorang

Rencana manajemen berfungsi untuk memformalkan prosedur dan polis asuransi yang penting bagi organisasi Anda serta kewajiban dan wewenang setiap orang yang terlibat dalam menjalankannya. Mereka

Tema yang diperlukan adalah cahaya, warna, bayangan, bahan, bentuk, desain furnitur, dan depth arsitektur dalam suatu lingkungan. Ini sangat penting secara negatif dalam suasana kantor

Mengevaluasi Ide Desain Responsif Berdasarkan Framework Terwujud Pada Situs World wide web “Tema desain” ruang harus diberi arti penting saat memilih gambar. Dan itu adalah

Silakan tambahkan foto Anda sebagai balasan untuk pengumuman masalah hari ini jika tidak, tidak seluruh Tim Desain mungkin dapat melihatnya dan… Anda mungkin memiliki banyak

4. Apakah desain atau subsistemnya sudah disimulasikan? Dari sudut pandang pengguna, desain UX yang baik pada akhirnya memungkinkan kita menjalani kehidupan sehari-hari semudah mungkin. Manfaat

Terutama di industri musik atau movie independen, produser pemerintah dapat melakukan hampir semua hal kecil yang tidak ditangani oleh artis dan kru. Selanjutnya, mari kita

9 Alasan Orang Mencibir Tentang Anda Membeli Produk Secara On the net Mulailah mendapatkan penawaran langsung dari para profesional kami secara instan. Penipu ini benar-benar

Faktanya, masa-masa indah tidak akan berlangsung terus-menerus, dan kemerosotan pasar saham terbaru yang terjadi dalam menghadapi penyebaran COVID-19 berbicara tentang betapa bergejolaknya perekonomian. China akan

300) Dan Mesin Pencari Boolean Pergi ke situs agregator individu dan mengirimkan umpan RSS Anda adalah proses yang rumit dan membosankan dan Anda mungkin tidak

Sudah umum di Eropa, Practical Car bertubuh kecil tetapi sangat ekonomis. Lihat cuplikan mobil ekstra kecil. Great Fortwo yang diperbarui (dinamai karena “untuk dua” orang)

Hilangkan Pasar Sekali dan Untuk Semua Perusahaan yang berbasis di Inggris ini mengumpulkan dana $144 juta untuk mengembangkan handset, yang diharapkan Pei akan menghidupkan kembali

Waspadai Penipuan Ekonomi Dapat dipahami dalam ekonomi ini untuk menganggap harga termurah adalah harga terbaik, tetapi tidak dengan AC. Sebuah survei oleh CIOB mengungkapkan bahwa

Pekerjaan Apa yang Sebenarnya Harus Anda Miliki? Tahukah Anda apa yang akan dilakukan pasar actual estat dalam jangka waktu tersebut? Jika Anda tahu Anda ingin

Informasi Rahasia Tentang Taruhan Yang Hanya Diketahui Para Pakar Sama seperti di NFL, sportsbooks juga menawarkan taruhan pada garis taruhan sepak bola perguruan tinggi. Selain

Cara Memilih Salah Satu Penyedia Backlink Terbaik Tahun 2022 Coba Rahasia Backlink Energi saat ini untuk mempelajari bagaimana Electrical power Inbound links Membantu Web optimization

Pada akhirnya, melakukan audit Website positioning teknis perutean dapat menghasilkan keuntungan besar jika diselesaikan secara akurat. Humor mungkin merupakan cara lain untuk mendapatkan setiap hyperlink

Namun demikian, yang terbaik adalah memastikan bahwa backlink PBN ini berguna di situs world-wide-web Anda. Tapi bukan sembarang situs otoritas area yang berlebihan – backlink

Tempat Anda Dapat Menemukan Aset Mesin Pencari Gratis Search engine marketing Adalah proses untuk membuat visibilitas situs website atau halaman Net apa pun di Mesin

Bagaimana Video Membantu Peringkat Search engine optimisation? WordPress adalah salah satu CMS terbaik untuk Search engine optimization. Sejak dirilis pada tahun 2003, WordPress tidak pernah

Jadi, dengan mempertimbangkan semua hal, strategi Website positioning Anda tidak akan efektif tanpa memprioritaskan pengoptimalan seluler. Search engine marketing pada halaman menghasilkan peningkatan peringkat pencarian,

Pedoman Audit Seo – Tingkatkan peringkat Search engine optimization situs world wide web Anda dengan pedoman audit Search engine optimisation kami. Misalnya, jika peringkat dalam

Dan jangan pernah membagikan kata sandi Anda dengan siapa pun. Ini memungkinkan pekerja untuk berkolaborasi secara waktu nyata, berbagi dokumen, dan melindungi informasi. Integrasi asli

Sayangnya, kami masih menjumpai organisasi di mana berbagai disiplin ilmu manajemen information tidak akan dipahami (atau lebih menakutkannya sengaja tidak ditangani). Berikut beberapa penjelasannya. Orang-orang

Apa yang Anda pelajari dari kehancuran pasar inventaris? ”, dan lain sebagainya, mengambil pasar listrik misalnya conejo2010decision . Meskipun demikian, pemodelan ketidakpastian di pasar listrik

Mungkin diperlukan pasukan untuk menggali melalui gundukan studi cerita dan memangkas sektor menjadi ukuran yang dapat dikelola, dan kemudian militer lain untuk memilih dan memilih

SEC menuduh unit Citigroup melakukan ini selama bencana keuangan tahun 2008 ketika menaikkan harga produk moneter yang terkait dengan pasar perumahan dalam upaya untuk menurunkannya

Posisi off-harmony sheet yang timbul dari pergerakan antagonistik dalam biaya pasar. Elektron yang tersisa diberi nama elektron pi dan bebas bermanuver dalam ruang tiga dimensi,

Perhatian : Secara tradisional, Oktober sering kali merupakan bulan dengan kinerja terburuk untuk pasar inventaris. Penipu tahu bahwa orang biasanya berhati-hati ketika mereka mulai melihat

Mereka naik menjadi $97 per saham sebelum mereka menetap di $63,50 pada penutupan pasar. 1. Survei Pasar untuk segmentasi: Perusahaan dapat melihat klien yang ada

Sepuluh Alasan Pasar Adalah Buang-Buang Waktu Rute yang jauh lebih tidak berisiko adalah menandai perusahaan dengan publisitas penting ke Rusia, seperti Pepsi, McDonald’s, dan Philip

Pengujian genetik ilmiah dan medis diatur oleh Amandemen Peningkatan Laboratorium Klinis (CLIA), tetapi pasar langsung ke klien sama sekali tidak diatur. Meskipun ada beberapa penilaian

Pendekatan sehari-hari yang dilakukan oleh penelitian tentang anomali volatilitas rendah adalah dengan mengurutkan saham sesuai dengan volatilitas historisnya dan membentuk portofolio, baik yang berbobot sama

Ini adalah dunia yang unik saat ini, dengan persaingan ekstra di area pasar komputer. Saat itu, Personal computer Windows merupakan mayoritas komputer yang ada di

Sulit memperkirakan jumlah yang tepat dari backlink nofollow untuk menjadi bagian dari profil backlink Anda, tetapi sesuatu seperti 5-20 computer nofollow hyperlink masuk akal untuk

Pada pekerjaan ini, kami mengembangkan suasana simulasi multi-agen untuk menangkap elemen kunci dari sistem keuangan system, termasuk berbagai guncangan ekonomi yang mengganggu pasar tradisional di

Situs website media sosial seperti Fb, Twitter, dan LinkedIn adalah alat penting yang akan membantu Anda mencapai concentrate on pasar on the net. Dalam upaya

Memilih Peringkat Google yang Baik Saya memberi tahu Anda itu karena saya ingin menjelaskannya tepat di awal teks ini. Google harus memercayai situs Anda jika

Membuat situs world wide web Anda sepenuhnya ramah seluler dapat membantu meningkatkan peringkat halaman di Google yang terkait dengan penelusuran seluler. Selama beberapa tahun terakhir

Mereka berbiaya sangat rendah tetapi memberi Anda sedikit perubahan yang harus Anda cerahkan pada desain yang ada. Dianjurkan untuk melihat apakah kandidat terpilih Anda mampu

Pertanyaan ini sama pentingnya bagi pemenang lotere yang serius dengan menemukan grup pengelolaan uang yang tepat. Manajemen tingkat tertinggi mengambil semua pilihan utama. Bahkan kualitas

Jika Anda ingin mengikuti pengamatan Kewirausahaan, Anda harus memulai program Magister Manajemen Strategis pada bulan Januari. Scrum grasp juga akan menilai kemajuan secara holistik, dan

Kebijakan permodalan sasaran perusahaan asuransi merupakan bagian integral dari bahaya dan rencana pengelolaan permodalannya, dan kemungkinan akan digunakan untuk memberitahukan kebijakan dividen dan untuk menentukan

Jangan Buang Waktu! Empat Element Hingga Anda Mencapai Manajemen Anda Dari sudut pandang administrator, manajemen adalah sistem otoritas. Agar pengetahuan dapat ditransmisikan dengan bersih dari

Untuk tampilan desain interior yang menarik, coba gunakan berbagai pola dan tekstur untuk mendekorasi ruangan yang sedang Anda dekorasi. Coba gunakan cermin untuk mereplikasi cahaya

McNamara, Carter. “Memulai Organisasi Nirlaba.” Perpustakaan Manajemen Gratis. Dalam teks ini, kita akan melihat bagaimana dewan amal dibentuk, diatur, dan apa yang mereka lakukan untuk

8 Cara Utama Yang Digunakan Para Profesional Untuk Itu Muse mendapatkan sebagian besar dananya dari komisi yang diperoleh dari kreditur yang bekerja dengan layanan manajemen

Cara Meningkatkannya Dalam 60 Menit

Itu tidak berurusan dengan bentuk inspirasi desain tertentu, tetapi itu menyediakan alat untuk fokus pada tema eksplisit jika Anda mau. Tetapi kontra menjadi lebih jelas

Pengguna dapat memilih dari tampilan fungsional hingga tailor made-manufactured, dan memilih varian tekstur, warna, cengkeraman, dan banyak lainnya. Selama sistemnya aman, pelanggan akan menikmati vaping

Yang tersedia di toko-toko sangat bergaya – cocok dipadukan dengan gaun hitam kecil yang cantik itu! Banyak kali toko offline menyediakan barang dagangan yang dibatasi.

3 Recommendations Sukses Hukum LA PAZ: Mantan Presiden Bolivia Jeanine Anez melukai dirinya sendiri dengan memotong pengurangan senjatanya saat berada di penjara pada Sabtu (21

3Cara Anda Perlu Menggunakan Match On the web Untuk Menjadi Menarik Bagi Klien Dengan maksud untuk mempelajari pengaruh konstruk tersebut dengan persaingan yang berlebihan, penelitian

New York Giants vs Chicago Bears Free NFL Picks: Monday Evening Football picks kembali hadir di Bang the Book, dan kami di sini dengan pertarungan

Sebagian besar sponsor ini mungkin dianggap kontroversial karena keterkaitan antara buku pacuan kuda dan acara itu sendiri, tetapi tidak ada argumen mengenai kontribusi buku balap

Tingkatkan Penjualan Kotor Anda Dengan Taktik Recreation On-line Luar Biasa Ini Sebagian besar dari mereka yang memainkan beberapa online video game on line ini biasanya

Taruhan – Apa Itu? Kunjungi salah satu region kami di New Buffalo, Hartford, atau Dowagiac untuk mengajukan tawaran agar tim favorit Anda menang di salah

Ini adalah metode yang terjangkau namun efisien untuk menarik perhatian rekan-rekan. Cara terbaik agar barang dagangan Anda diperhatikan adalah presentasi yang baik, dan cara termudah

Apa yang Dilakukan Taruhan Online? Situs internet permainan yang benar-benar gratis telah menjadi tempat bagi para pemain untuk bertemu dan melakukan interaksi sosial. Mulailah mengikuti

Olahraga On the internet Dan Dampak Chuck Norris Banyak match olahraga untuk konsol Nintendo wii menyertakan beberapa jenis perangkat yang terintegrasi, atau bahkan didistribusikan secara

Orchard Protection – Orchard Protection adalah game harian on the web baru yang menjadi populer di banyak situs web arcade, dan didasarkan pada mesin game

Artikel ini menyangkut bagian penting dari keamanan kartu kredit Anda. Selama Anda mendapatkan individu yang andal dengan sejarah kredit yang bagus untuk menandatangani hutang Anda,

Ubah Olahraga Anda Menjadi Mesin Berperforma Tinggi Perusahaan perangkat lunak permainan movie terkemuka dapat memberi Anda beragam instrumen teknologi trendi untuk dipilih. Banyak gamer menjelajahi

Dalam ranah pendidikan, kontes teritorial antara departemen mengklaim pengalaman pariwisata dan orang mengklaim pengalaman olahraga perlu diatasi. Klub-klub ini adalah dua dari 5 tim terakhir

Draf Otomatis

Mengapa Bertaruh Adalah Satu-Satunya Kemampuan yang Anda Butuhkan hanabet bekerja dengan baik. Kursi latihan olahraga ab lounge tidak diragukan lagi adalah salah satu instrumen peralatan

Berikut adalah 7 cara meningkatkan olahraga Kriket telah diringkas dengan tepat sebagai permainan memukul bola satu for every satu. Bola itu keluar dengan kecepatan 102,8

Perdebatan Tentang Video game On the net Beli Jam Tangan Pengoperasian GPS Secara On line – Anggota Recurrent Flyer Onsport 1 Qantas akan mendapatkan 5

Apa yang terjadi pada Anda untuk dengan mudah mendapatkan dan. Jika Anda melihat staf Anda mengetuk simbol bintang dan tim Anda akan terdaftar di bawah

Dapatkan Hasil Recreation Online Lebih Baik Dengan Mengikuti Tiga Langkah Sederhana Pengujian video clip sport adalah pekerjaan yang serius dan disertai dengan tanggung jawab, tetapi

Diajari Untuk (Melakukan) Situs World wide web Activity Seperti Berpengetahuan 26 September 2021 Berita Metode untuk menemukannya dibahas dalam semua langkah di situs semacam ini

Sepuluh Opsi Untuk Pertukaran Crypto 24 September 2021 Berita Setiap investor yang ingin mengeksploitasi keuntungan yang difasilitasi di pasar ini harus tahu cara menggunakan bagan

daftar match pkv yang terkait dengan aplikasi ini juga sepadan dengan PageRank dan Alexa. Di bawah ini adalah tampilan mendetail pada lima aplikasi Iphone dan

Versi berbayar akan memberikan masing-masing opsi ini tanpa konsesi apa pun. Versi pro biasanya hadir dengan opsi yang disempurnakan. Itulah mengapa penting untuk proyek yang

Rumor, Kebohongan dan Taruhan Tidak ada kecelakaan yang diakui pada salah satu bintang terkenal untuk Patriots, jadi kami akan berharap untuk melihat mereka keluar dari

Inilah Mengapa 1 Juta Klien Di AS Adalah Taruhan Olahraga Bertaruh pada tim favorit Anda setiap saat bukanlah resolusi taruhan olahraga World-wide-web yang matang. Investasi

1 DOR! situs303 , ada situs world wide web lain di world-wide-web yang menyajikan catatan facts yang berguna, alat modding dan perluasan, jawaban atas pertanyaan,

Menghubungkan Lebih Tinggi Melalui Sains: 6 Rahasia Untuk Strategi Membangun Hyperlink yang Efektif Di Seo Miami, kami menyediakan strategi Search engine marketing yang disesuaikan untuk

Dapatkan Hasil Situs World-wide-web Match Lebih Tinggi Dengan Mengikuti Tiga Langkah Mudah Sebagian besar situs world wide web juga akan meminta Anda untuk memberi mereka

Apa pun konsol atau keinginan recreation favorit Anda, cari di sekitar situs world-wide-web terbaik untuk menemukan yang Anda butuhkan dengan cepat. 1) Harga terjangkau: Kisaran

Artikel-039 Apa yang Alberto Savoia Dapat Latih Anda Tentang Situs World-wide-web Sport Yang benar adalah bahwa ada banyak ketukan on-line yang dapat Anda temukan, tetapi

Delapan Hal yang Harus Diajarkan Ibu Anda Tentang Kasino On the web Ross Everett adalah penulis lepas yang dicetak secara luas dan otoritas terkenal dalam

Taruhan Olahraga Beberapa Faktor Yang Perlu Direnungkan Agar Menguntungkan – Perjudian Ini bukan semata-mata karena biayanya agak rendah untuk perusahaan tetapi umpan yang disediakan kembali

Item electronic seperti Super Hero Squad Online Gold dan kode lainnya mungkin akan dikirimkan melalui email kepada Anda. Saya kemudian menjumlahkan keseluruhan dan peserta dengan

Apakah Faktor Taruhan Ini Benar-Benar Sulit Kami memiliki peluang taruhan sepak bola hari ini, peluang taruhan bola basket, peluang taruhan bola voli, peluang taruhan tenis,

Siapa Lagi Yang Ingin Menikmati Video game On the web Mereka biasanya memprediksi hasil dengan benar. Jika Anda senang bertaruh pada olahraga dan balapan, Anda

8 Teknik Decrease-Throat Engage in Match On the net Yang Tidak Pernah Gagal Taruhan Hoki NHL – Pittsburgh Penguins mungkin merasa lebih betah daripada tamu

Mengapa Video game On the web Tidak Berfungsi…Untuk Semua Orang Jika Anda memiliki ide olahraga di benak Anda, maka tidak akan ada yang lebih baik

Pintasan Permainan Taruhan – Metode Mudah Hanya ada beberapa situs net yang bersifat nyata dan menyesuaikan diri menjadi situs website taruhan olahraga sejati. Semua situs

Teknik Video game On the web Menarik yang Dapat Membantu Perusahaan Anda Tumbuh Saya akan memberikan inspirasi mereka ketika saya akhirnya melakukan panduan karakter Robbers

Gim-gim ini memungkinkan Anda melihat pemandangan di atas kepala tentang apa yang sebenarnya terjadi saat Anda berada di dalam truk yang melakukan transfer. Dengan skor

Di dalam Injil Lukas, Yesus menganjurkan kepada murid-muridnya: “Ketika Anda mungkin telah mencapai semua yang telah Anda perintahkan, katakanlah, ‘Kami adalah hamba yang tidak layak.

Cara Mencari Setiap Bagian Yang Mungkin Perlu Diketahui Tentang Sport On-line Dalam 10 Langkah Mudah

Cara Mencari Setiap Bagian Yang Mungkin Perlu Diketahui Tentang Game On line Dalam 10 Langkah Mudah Apa itu Aplikasi Taruhan Olahraga? Apa pun olahraganya, pertandingan

Berita Taruhan – Tantangan Enam Angka Itu adalah hiburan bagi orang-orang kaya – mereka mengatur pacuan kuda dan anjing greyhound untuk memasang taruhan pacuan kuda

3 Instrumen Ekstra Keren Untuk Game Online Untuk melengkapi ruang media yang sebenarnya, Anda memiliki berbagai peralatan PlayStation, seperti qore yang menawarkan online video definisi

Empat Lagi Instrumen Keren Untuk Activity On the net Untuk melengkapi ruang media yang sebenarnya, Anda memiliki berbagai peralatan PlayStation, seperti qore yang menawarkan video

Tiga Lagi Alat Keren Untuk Activity On-line Untuk melengkapi ruang media yang sebenarnya, Anda memiliki berbagai peralatan PlayStation, seperti qore yang menawarkan video clip definisi

Tiga Ide Terbaik Untuk Taruhan Olahraga judi online ditandatangani dengan Metal Blade Facts pada tahun 1998 dan popularitas mereka meroket di seluruh dunia. Amon Amarth

Mengapa Bermain Match Online Adalah Satu-Satunya Kemampuan Yang Anda Butuhkan Katakanlah Anda tidak tahu tentang olahraga hoki es dan semua yang Anda pelajari tentang permainan

Estimasi Biaya Pengembangan Aplikasi Taruhan Olahraga & Halaman World wide web Dengan Fitur Jangka panjang dari apa yang Anda promosikan dapat bergantung, sebagian besar, pada

Cara Mudah Bermain Togel On line? Mereka memiliki promosi yang berbeda seperti – taruhan free of charge, voucher taruhan, uang kembali, dan bonus pembayaran. Bonus

Strategies Cara Bermain Togel On line? Mereka memiliki promosi yang berbeda seperti – taruhan gratis, voucher taruhan, uang kembali, dan reward pembayaran. Reward ini tidak

Game On line – Beberapa Saran Untuk Para Pemula – Sport On the web Permainan remi India menawarkan stimulasi intelektual. Setelah Anda memainkan game on

Dunia Sport On the net yang Fantastis – Sport On the internet Dunia Sport On the net yang Fantastis – Sport On the internet Match

20+ Tempat Untuk Menjual Barang Secara On line Dan Dapatkan Bayaran Cepat poker88 memberikan lebih dari 10.000 toko on-line. Sementara toko parfum yang tepat melakukan

Informasi Publik Standard Baru Tentang Match On the web Tera – Game On the web Jika Anda harus mengambil kelas favorit Anda dan bermain maka

Bosan Dengan Video Match Fb? Pemberian mungkin mengharuskan Anda untuk membeli barang atau mendaftar ke layanan. Hal pertama yang harus Anda cari di situs game

10 Situs Streaming Televisi Langsung Untuk Menonton Saluran TV Langsung Secara Online

10 Situs Streaming Televisi Langsung Untuk Menonton Saluran TV Langsung Secara Online Setiap minggu, selebritas dari dunia olahraga, musik, komedi, televisi, dan film akan saling